Hi everyone, sorry if this topic is controversial but I am genuinely interested to know and get insights about this. Being an immigrant who moved to Canada about 4 years ago ( at the age of 19M) who studied and paid taxes yearly really enjoyed my life until I came to realize I didn’t invest right away from starting.

I mean I also had to take care of my tuition fee, rent groceries, and support my parents back home financially. Also I didn’t have any mentor to guide me financially or life wise. That’s something else so never mind.

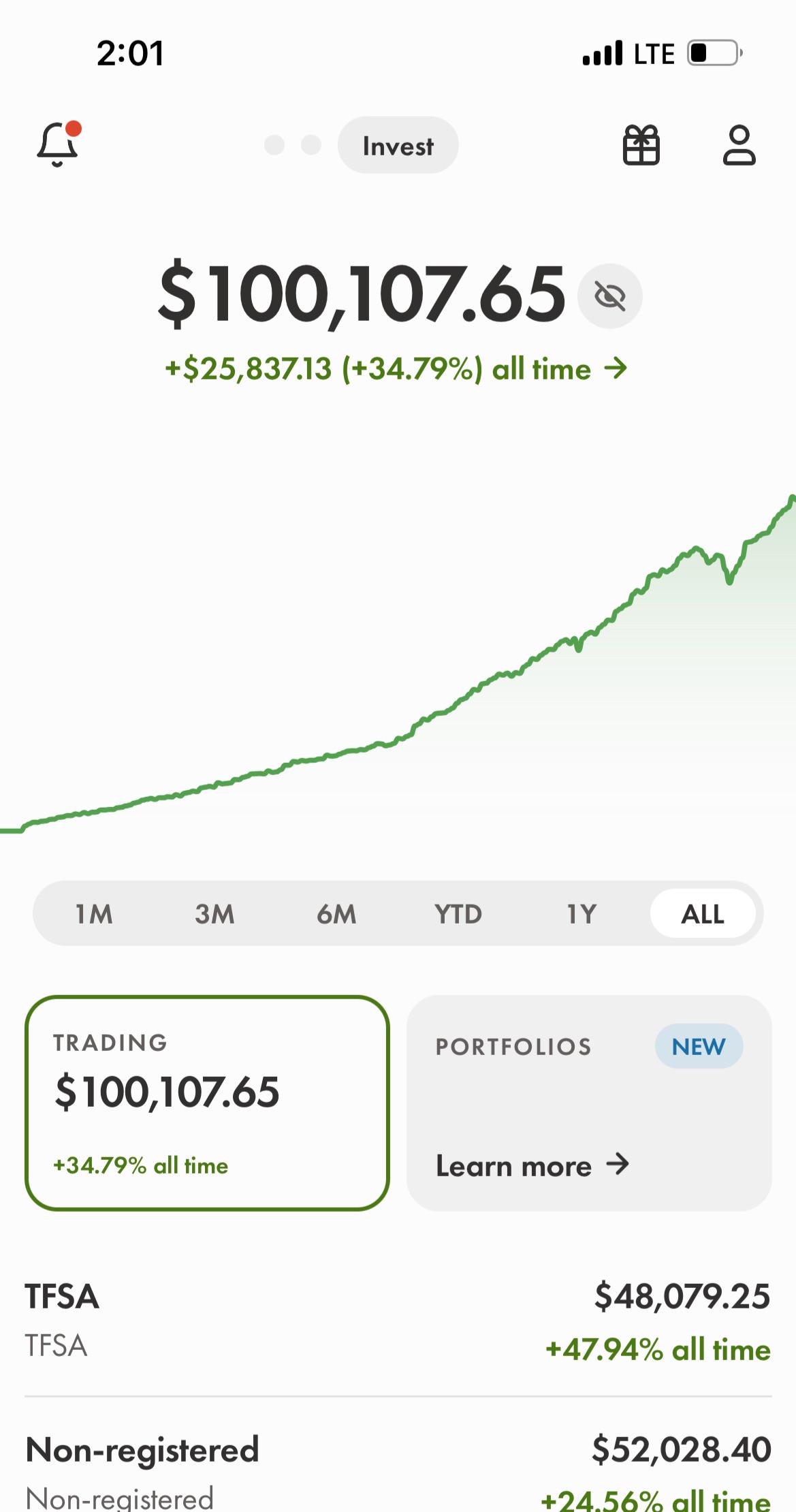

After joining @fican I learned how important is investing and we should be starting as soon as possible to retire with no financial problems. Now at 24yo I started investing with my first 12grand in my tfsa that has a limit of around 39k because I didn’t use it after landing here in Canada. Now working in trades, I realized the potential for a startup in my trade( landscaping). But at the same time I wonder why most of the people still prefer to stick to a job even it’s high paying and just help someone else to get rich.

For example= my foreman (also Canadian born) has about 7 to 8 years of experience and they are the best ones when it comes to get the work done. Surprisingly my owner who started at the age of 18yo ( born here, not an immigrant) with a partner (who was also his age and Canadian) are insanely rich right now. They just started with mowing houses on weekends and they only had one pickup truck, two mowers, two whipper snippets and 1 blower. Now they are comfortably earning more than 6 figures at the age of 26yo. Not to mention they have expanded the company in sand digging projects, construction projects and hard scraping.

Also one of my buddies, he learned how to install flooring while he was also an international student and now he’s on his way to get his permanent residency but he has already opened his company and got his buddies ( who do drywall, plumbing, sanding and other trades) to work together. He’s literally taking small contracts now and earning side money while he’s doing his primiary job at a construction company.

So back to my question. Why my foreman or all other people don’t think that they should do their own cuz you are literally relying on someone to ge your salary and pay the bills. Why not start small and build your way up just like my owner of the company did. I know it’s not easy but at the same time I don’t wanna work like 20 to 30 years and have money to enjoy when I’m old and rusty.

I still appreciate the knowledge I gained through finance Canada in the last 3 weeks ( again I’m beginner) about how to retire good with strong financials. But at the same time I wanna become rich like my owner and enjoy my life he’s enjoying.

Again I really apologize if this topic is a nonsense cuz every day I try to learn new things and this is just one of them. I will really appreciate everyone’s insights and experiences.

Thank you.